DATE: Friday, May 15, 2020 | | ITEMS OF BUSINESS: 1. Marriott SpringHill, 120 East Redwood Street, Baltimore, Maryland, at 10:00 a.m. on May 7, 2018, for the purpose of considering and acting upon:

1. | Election of Directors: | | directors: Holders of Class A Common Stock to elect six directors. | | Holders of Common Stock to elect two directors. 2. | 2. | Ratification of the appointment of Grant Thornton LLP as our independent auditor. | | registered public accounting firm for 2020. 3. | Transact such other business as may properly come before the annual meeting or any adjournments. |

The Board of Directors has fixed the close of business on March 9, 2018, as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournments thereof. Only holders of Common Stock and Class A Common Stock are entitled to vote.

If you are a holder of Common Stock or Class A Common Stock, a proxy card is enclosed. Please vote your proxy promptly by internet, telephone or by mail as directed on the proxy card in order that your stock may be voted at the Annual Meeting.

You may revoke the proxy at any time before it is voted by submitting a later dated proxy card or by subsequently voting via internet or telephone or by attending the Annual Meeting and voting in person.

March 28, 2018

By Order of the board of directors

Jenny Hill Parker

Senior Vice President, Finance,

Secretary and Treasurer

| | | |  | | Vote your shares onlinePLACE:

Marriott SpringHill 120 East Redwood Street Baltimore, Maryland | | RECORD DATE: March 13, 2020 If you are a holder of record of Common or Class A Common Stock at the close of business on March 13, 2020, then you are entitled to receive notice of and to vote at the meeting. | |

PLEASE VOTE: Please carefully review the proxy materials and follow the instructions to cast your vote in advance of the meeting. | | | | | Internet: Visit - www.proxyvote.com.* | Vote your sharesTelephone

by callingCall - 1-800-690-6903.1-800-690-6903*

| Vote by mail. Sign, date and return your Notice or proxy card or voting instruction form. | *You will need the 11-digit control number included in the enclosed envelope.your proxy card, voting instructions form or notice. | | |

As a stockholder, your vote is very important, and the company’s board of directors strongly encourages you to exercise your right to vote.

BY ORDER OF THE BOARD OF DIRECTORS

Jenny Hill Parker Senior Vice President, Finance, and Corporate Secretary

April 1, 2020 Atlanta, Georgia

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDERS MEETING TO BE HELD ON MAY 7, 2018: Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on May 15, 2020. The proxy statement and Havertys' Annual Report on Form 10-Kannual report for the 2017 fiscal year2019 are available at www.proxyvote.com. These materials are also availablewww.proxyvote.com and on Havertys'Havertys’ Investor Relations website at havertys.com under "Investor Information,"“Investor Information” then "SEC“SEC Information."” |

| TABLE OF CONTENTS | | | | | | | 2 | | 4 | | | | 5 | | 5 | | 6 | | 6 | | 7 | | 7 | | 8 | | | | 1011 | | 1011 | | | | 1112 | | 1213 | | | | 1314 | | 15 | | 1416 | | 17 | | 1520 | | 18 | | 21 | | 2322 | | | | 2423 | | 25 | | 26 | | 27 | | 28 | | 29 | | 29 | | 3332 | | 3332 | | 34 | | 33 | | 3634 | | 3836 | | 3937 | | 4139 | | 4239 | | 4240 | | | | Appendix |

The board of directors currentlyhas a rigorous process to ensure that the composition of directors is diverse, balanced and aligned with the evolving needs of the company. Currently the board consists of nineeight members. One of our current directors, Mr. L. Phillip Humann, has reached the mandatory retirement age for directors under our Corporate Governance Guidelines and will not stand for re-election. Accordingly, at this annual meeting, the slate of directors will be eight. The holders of Class A common stock will elect six directors and holders of common stock will elect two directors. Each elected director will hold office until the next annual meeting. The election of our directors requires a plurality of votes cast at the meeting by the holders of the respective classes of common stock.

Election of Havertys Board of Directors |

| What am I voting on? | ✓✔ Holders of Class A Common Stockcommon stock are being asked to elect six director nomineesdirectors for a one-year term.

✓✔ Holders of Common Stockcommon stock are being asked to elect two director nomineesdirectors for a one-year term.

| | Voting recommendation: | ✓✔ Our board of directors recommends a vote "For"“For” each of the director nominees.

|

The nominees for election at the 20182020 annual meeting were approved for nominationrecommended by the Nominating and Corporate Governance Committee (the "Governance Committee"“NCG Committee”) of the board. All of the nominees are currently directors of Havertys. We expect that each of the nominees will be available for election, but if any of them is unable to serve at the time the election occurs, it is intended that the proxies will vote for the election of another nominee to be designated by the GovernanceNCG Committee and the board.

Our board is a diverse, highly engaged group of individuals that provides strong, effective oversight of our Company.Havertys. Both individually and collectively, our directors have the qualifications, skills and experience needed to inform and oversee the Company'scompany’s long-term strategic growth priorities. The board believes that certain experience, qualifications, attributes and skills should be possessed by Havertys'Havertys’ board members because of their particular relevance to the company'scompany’s business and structure, and these were all considered by the board in connection with this year'syear’s director nomination process.

The biographies of each of the nominees contain information regarding the person'sperson’s experience and director positions held currently or at any time during the last five years. The fact that an icon is not shown does not mean the individual does not possess the experience, qualification or skill.

| Experience and Skills Legend |

| | | | | | | | | Current/Former CEO | Public Board Exerience | Finance | Risk Assessment | Consumer Focused | Corporate Finance and Reporting

| Finance | Furniture Industry | Marketing/ Brand Building | Risk Management | Sales |

Proposal 1: Nominees for Election by Holders of Class A Common Stock |

| John T. Glover Age 73 | Independent Director since 1996 Age 71 Lead Director since 2017

| Principal Occupation: Retired, Vice Chairman of Post Properties, Inc., a real estate investment trust that developsdeveloped and operatesoperated upscale multifamily apartment communities, from March 2000 to February 2003; President of Post Properties, Inc. from 1994 to 2000. Post Properties, Inc. was acquired in 2016 by Mid-America Apartment Communities, Inc.

Directorships: Member of the Board of TrusteesEmory Healthcare Inc., Trustee Emeritus of Emory University, a Director of Emory Healthcare, Inc. and Trustee Emeritus of The Lovett School.

| | Rawson Haverty, Jr.Management Director since 1992 Age 6163 Principal Occupation: Senior Vice President, Real Estate and Development of Havertys since 1998. Over 3335 years with Havertys in various positions. Directorships: Chick-Fil-A Foundation, Akola Project, StarPound Technologies, and World Children's Center and a member of the Advisory Board of the Center for Ethics at Emory University. | | Mylle H. Mangum Independent Director since 1999 Age 6971 Principal Occupation: Chief Executive Officer of IBT Enterprises,Holdings, LLC, a provider of design, construction and consultant services for the retail banking and specialty retail industries since 2003.

Directorships: Barnes Group, Inc., Express, Inc., PRGX Global, Inc., and The Shopping Center Group.

|

| Proposal 1: Nominees for Election by Holders of Class A Common Stock |

| Vicki R. PalmerIndependent Director since 2001 Age 6466 Principal Occupation: Retired, former Executive Vice President, Financial Services and Administration for Coca‑Cola Enterprises Inc. from 2004 until 2009. Senior Vice President, Treasurer and Special Assistant to the CEO of Coca-Cola Enterprises Inc. from 1999 to 2004.

Directorships: First Horizon National Corporation and a member of the Governing Board of Woodward Academy.

| | Clarence H. Smith Age 69 | Management Director since 1989 Age 67 Chairman of the board since 2012

| Principal Occupation: President and Chief Executive Officer of Havertys since 2003. Over 4345 years with Havertys in various positions.

Directorships: Oxford Industries, Inc. and member of the Board of Trustees of Marist School. | | Al TrujilloIndependent Director since 2003 Age 5860 Principal Occupation: President and Chief Operating Officer of the Georgia Tech Foundation since 2013. Investment Funds Advisor from 2007 to 2013. Former President and Chief Executive Officer of Recall Corporation, a global information management company until 2007. Various positions with Brambles Industries, Ltd, parent company of Recall Corporation from 1996 until 2007. Directorships: SCANA Corporation and a memberMember of the Board of Trustees of Marist School.School and former director of SCANA Corporation. SCANA Corporation was acquired by Dominion Energy in 2018.

| | Clarence H. Smith and Rawson Haverty, Jr. are first cousins and officers of Havertys. |

Proposal 1: Nominees for Election by Holders of Common Stock |

| L. Allison Dukes Independent Director since 2016 Age 4345 Principal Occupation: Deputy Chief Financial Officer, Invesco Ltd. since March 2020. Former Chief Financial Officer for SunTrust Banks, Inc., from March 2018 until December 2019. Head of Commercial Banking for SunTrust Banks, Inc. from 2017 until 2018. President, Chairman and CEO of the Atlanta Division of SunTrust Banks, Inc. from 2015 until 2017. Executive Vice President and Private Wealth Management Line of Business Executive from 2013 until 2014. Chief Financial Officer of Consumer Banking and Private Wealth Management in 2012. Balance Sheet Manager from 2010 until 2011 and Managing Director and Head of Syndicated Finance Originations at SunTrust Robinson Humphrey from 2008 until 2009.

Directorships: Member of the Executive Board of Junior Achievement of Georgia and a member of the boardsBoard of Children'sTrustees of Children’s Healthcare of Atlanta, the Alliance Theater,and the Atlanta History Center and a member of the Metro Atlanta Chamber of Commerce Executive Committee.Center.

| | Fred L. Schuermann G. Thomas HoughIndependent Director since 20012018

Age 7165 Principal Occupation: Retired, former PresidentAmericas Vice Chair of Ernst & Young LLP (“EY”). Vice Chair of Assurance Services of EY in New York from 2009 to 2014.

Directorships: Equifax Inc., Publix Super Markets, Inc. and Chief Executive Officera director/trustee of LADD Furniture Inc. ("LADD") from 1996 until 2001. Chairmanthe Federated Fund Family. Member of LADD from 1998 until 2000.the University of Alabama and Wake Forest University Business School Board of Visitors.

|

| L. Phillip Humann Independent Director since 1992

Age 72 Chairman of the board from 2010 to 2012

Lead Director from 2012 to 2017

| Principal Occupation: Retired, former Chairman of the Board of SunTrust Bank, Inc. ("SunTrust") from 1998 to 2008. Chief Executive Officer of SunTrust from 1998 to 2007 and President from 1998 to 2004.

Directorships: Coca-Cola Enterprises Inc. and Equifax, Inc.

|

The following sections provide an overview of our corporate governance structure and processes as it relates specifically to our board of directors. Our company is led by Clarence Smith, who has served as chief executive officer since 2003 and chairman of the board since August 2012. Our board nominees are composed of six independent directors and two management directors. Our independent directors meet in executive session at each board meeting.

Chairman/CEO: We believe that having a combined chairman/CEO, independent chairs for each of our board committees, and an independent lead director helps provide strong, unified leadership for our management team and board of directors and is currently the right structure for our company. We have one individual who is seen by employees, business partners, and stockholders as providing leadership for Havertys and we have experienced independent directors providing oversight of company operations. Although the board believes that separate positions are not appropriate in the current circumstances, our Governance Guidelines do not establish this approach as policy. The board believes that it should have the flexibility to make these determinations at any given point based on what it considers is the appropriate leadership structure for Havertys at the time.

Lead Director: UnderConsistent with industry best practices, our Governance Guidelines, in the absence of an independent chairman, the independent directors select one independentlead director as the board's lead director.helps Havertys maintain a corporate governance structure with appropriate independence and balance. The lead director chairs the executive sessions of independent directors and facilitates communications between the chairman/CEO and other directors. OurThe lead director, helps the Company maintain a corporate governance structure with appropriate independence and balance.currently John Glover, currently serves as lead director.is elected by the independent directors annually.

Inherent in the board'sboard’s responsibilities is an understanding and oversight of the various risks facing the Company.company. Effective risk oversight is an important priority of the board. While theThe board has the ultimateexercises its oversight responsibility variousfor risk both directly and through its committees of the board assist the board andwhich have specific areas of focus for risk management. The board as a whole examines specific business risks, such as cyber security,those associated with our business model and innovation, supply chain, and cybersecurity, in its regular meetings in addition to the reports from its committees.

| Continuous oversight of overall risks, with emphasis on strategic risks, as well as operational and reputation risks.

| | | Oversees the risk management process, with a focus on financial risk, internal controls and annual risk assessments with our internal auditors and other members of management.

| Compensation policies, practices and incentive-related risks, organizational talent and culture, and management succession risks.

| Governance structure, board composition and compliance matters.

| | | | Responsible for the day-to-day management of the risks facing the Company.

| | |

Our board had fourhas three standing committees in 2017:committees: Audit Committee, Compensation Committee, GovernanceNCG Committee and Executive Committee. The table below shows the current membership, (✓ indicates independent member), the principal functions and the number of meetings held in 2017:2019:

| Name, Meetings and Members | | Principal Functions | Audit Committee Meetings: 4 Independent Members:

✓Al Trujillo – Chair

✓ Allison Dukes

✓John Glover

✓Tom Hough

Vicki Palmer ✓ Fred Schuermann

Each member has been designated as “an audit committee financial expert” as defined by the Securities and Exchange Commission (“SEC”) and meets the independence requirements of the New York Stock Exchange (“NYSE”), SEC, and our Governance Guidelines as well as the enhanced standards for Audit Committee members in Section 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). | | · Represents and assists• Discusses the board in fulfilling its oversight responsibility relating to the quality and integrity of our annualthe company’s accounting policies, internal controls, financial reporting, practices and interim external consolidatedthe financial statements.statements with management, the independent auditors and internal audit.

· • Reviews and discusses with management the Company'scompany’s risk assessment framework and management policies, including the framework with respect to significant financial risk exposures.

· • Monitors the qualifications, independence and performance of the Company'scompany’s internal audit function and independent auditor and meets periodically with management, internal audit and the independent auditor in separate executive sessions.

· • Other matters as the board deems appropriate.

·

| NCG Committee Meetings: 2 Mylle Mangum – Chair John Glover Allison Dukes Al Trujillo Each member has been designated by the board as "an audit committee financial expert" as defined by the Securities and Exchange Commission ("SEC") and meets the independence requirements of the New York Stock Exchange ("NYSE"),NYSE, SEC and our Governance Guidelines. | Guidelines as well as the enhanced standards for Compensation Committee Meetings: 2 members in Rule 16b-3 promulgated under the Exchange Act.

Independent Members:

✓ Mylle Mangum – Chair

✓ John Glover

✓ Phil Humann

✓ Al Trujillo

| | · • Translates our compensation objectives into a compensation strategy that reinforces alignment of the interests of our executives with that of our stockholders.

· Succession planning.• Approves and evaluates the company’s director and executive officer compensation plans, policies and programs.

· Evaluates performance• Conducts an annual review and approves the compensation and benefitsevaluation of the chief executive officer and other executive officers.

· Reviews and administers our executives' compensation, equity-based compensation plans, and employee benefit plans.

· Each member meets the independence requirementsCEO’s performance in light of the NYSE, SECcompany’s goals and our Governance Guidelines.

| Governance Committeeobjectives.

Meetings: 3

Independent Members:

✓ Fred Schuermann – Chair

✓ Vicki Palmer

| | · • Reviews and makes recommendations for composition and structure of the board and policies relating to the recruitment of new board members and nomination and reelection of existing board members.

· • Oversees director compensation.the compliance structure and programs with annual reviews of Havertys’ corporate governance documents.

· • Reviews and recommends corporate governance policies and issues.

· Each member meets the independence requirements of the NYSE, SEC and our Governance Guidelines.approves related person transactions in accordance with board practices.

| Executive Committee Meetings: 0 Independent Members: ✓John Glover – Chair

✓ Phil Humann

✓Mylle Mangum

✓Al Trujillo

Management MemberMember: Clarence Smith | | · • In accordance with our bylaws, acts with the power and authority of the board in the management of our business and affairs in the interim between meetings of the board.

· • Generally, holds meetings to approve specific terms of financings or other transactions after these items have previously been presented to the board.

· Not an independent committee however, the majority of the members are independent directors.

|

Attendance. During 2017,2019, the board met four times and the committees met as indicated in the table outlining committee members and functions. Board membersEach director attended at least 78% of all of the board meetings and meetings of the committees on which they served during 2017.2019.

We do not have a policy regarding director attendance at the annual meeting of stockholders. We have historically received proxies representing approximately 90% of eligible shares and had no stockholders in attendance at our annual meetings. No directors attended the 20172019 annual meeting, and none are expected to attend the 20182020 annual meeting.

Non-employee directors receive a combination of cash and stock-based compensation designed to attract and retain qualified candidates to serve on the board and further align their interest with that of our stockholders. Messrs. Haverty and Smith, as management directors, do not receive any compensation for serving on the board. In setting director compensation, the GovernanceNCG Committee, which is responsible for determining the type and amount of compensation for non-employee directors, considers among other things, the size and complexity of our operations and the time that directors spend fulfilling their duties to Havertys and our stockholders. Retainer Fees. Non-employee directors receive an annual retainer, of which two-thirds is required to be paid in shares of common stock. The retainer is for the board year which begins in May of each year. We do not pay meeting fees for attendance at board and committee meetings, but attendance expenses are reimbursed. The following is a schedule of current annual retainers for non-employee directors:

| Type of Fee | | Amounts | Annual Board Retainer (1/3 cash - 2/3 stock)(1) | | $ 75,00081,000 | | Additional Annual Retainer to Lead Director | | $ 10,00012,000 | Additional Annual Retainer to Chair of Audit and CompensationNCG Committee | | $ 10,000 | Additional Annual Retainer to Chair of Governance Committee | | $ 7,500 | (1) In May 2018, the non-employee director annual retainer will increase to $81,000 of which $54,000 must be paid in common stock and the additional annual retainer to the lead director will increase to $12,000. |

Stock Grant. Non-employee directors receive a grant of fully-vested common stock in May each year with a grant date value of $20,000. Directors'Directors’ Deferred Compensation Plan. Non-employee directors may elect to defer receipt of the cash or common stock payment of their retainer and may elect to defer 100% of their annual retainer fee in shares of common stock under the Directors'Directors’ Deferred Compensation Plan ("(“Deferred Plan"Plan”). Under the Deferred Plan, deferred fees, plus any accrued interest (at a rate determined annually in accordance with the Deferred Plan which is not above market), shall be distributed in the future to a director in one lump sum or in no more than ten equal annual installments, or in accordance with the terms of the Deferred Plan. ThreeTwo directors participated in the Deferred Plan in 20172019 and two willthree have elected to participate in 2018.2020.

Other Compensation. Directors receive the same discounts as employees on our products. We do not provide any pension or other benefits to our non-employee directors. Director Stock Ownership Guidelines. The board has implemented stock ownership guidelines for non‑employee directors. Each director is required to own or hold at least 20,000 shares of our stock. New directors have five yearsare prohibited from datedisposing of their election to reach compliance.any shares until the guideline amount is reached. Currently, all non-employeenon‑employee directors meet, or are on track to meet, the stock ownership guidelines.

Compensation Earned for 2019.The following table sets forth information concerning total non-employee director compensation earned during 2017 bythe calendar year 2019 for each director. Messrs. Haverty and Smith, as management directors, do not receive any compensation for serving on the board. See "Summary“Summary Compensation Table"Table” regarding Mr. Smith since he is a Named Executive Officer ("NEO"(“NEO”). Mr. Haverty is also an executive officer, but not aan NEO.

| | | | Retainer Fees | | | | | Name | | Fees Earned or Paid in Cash ($) | | | Fees Earned or Paid in Stock ($) | | | Total ($) | | | Fees Earned or Paid in Cash ($) | | | Fees Earned or Paid in Stock ($) | | | Total ($) | | | Stock Grant ($) | | | Total Compensation ($) | | | Allison Dukes | | $ | 25,000 | | | $ | 50,000 | | | $ | 75,000 | | | $ | 27,000 | | | $ | 54,000 | | | $ | 81,000 | | | $ | 20,000 | | | $ | 101,000 | | | John Glover | | | 35,000 | | | | 50,000 | | | | 85,000 | | | 39,000 | | | 54,000 | | | 93,000 | | | 20,000 | | | 113,000 | | Phil Humann(1) | | | — | | | | 75,000 | | | | 75,000 | | | Tom Hough(1) | | | 27,000 | | | 54,000 | | | 81,000 | | | 15,285 | | | 96,285 | | | Mylle Mangum | | | 35,000 | | | | 50,000 | | | | 85,000 | | | 37,000 | | | 54,000 | | | 91,000 | | | 20,000 | | | 111,000 | | | Vicki Palmer | | | 25,000 | | | | 50,000 | | | | 75,000 | | | 27,000 | | | 54,000 | | | 81,000 | | | 20,000 | | | 101,000 | | | Fred Schuermann | | | 32,500 | | | | 50,000 | | | | 82,500 | | | | Al Trujillo | | | 35,000 | | | | 50,000 | | | | 85,000 | | | 37,000 | | | 54,000 | | | 91,000 | | | 20,000 | | | 111,000 | |

| (1) | | Mr. HumannHough was elected to obtain his annual board retainer fees in all stock. | (2) | Mr. Humann will not be standing for reelection to the board in 2018.August 2018 and received a pro rata grant for his board service. | |

Governance Guidelines and Policies Our board and management team are committed to achieving and maintaining high standards of corporate governance, as well as a culture of and reputation for the highest levels of ethics, integrity and reliability. We annually review our governance policies and practices against evolving standards. In considering possible modifications, our board and management focus on those changes that are appropriate for our company and our industry, rather than adopting a one-size-fits-all approach.

Our board recognizes that excellence in corporate governance is essential in carrying out its responsibilities to our stockholders, employees, customers, suppliers and communities. The board has adopted guidelines and a number of policies to support our values and good corporate governance and practices. These governance practices and policies include:

Director Independence. Our Corporate Governance Guidelines state that a majority of the directors must be non-management directors who meet the "independence"“independence” requirements of the NYSE. The GovernanceNCG Committee conducts an annual review to determine the independence of each director based on the standards contained in our Governance Guidelines and NYSE corporate governance requirements. The board, based on the recommendation of the GovernanceNCG Committee and its review, has affirmed that each of the following non-employee directors is independent and has no material relationship with the Companycompany that could impair their independence. ✓✔ Allison Dukes

| | ✓ Vicki Palmer

✔ Mylle Mangum | ✓ ✔ John Glover

| | ✓ Fred Schuermann

✔ Vicki Palmer | ✓ Phil Humann

✔ Tom Hough | | ✓ ✔ Al Trujillo

| ✓ Mylle Mangum

| | |

For more information regarding our policy on Transactions with Related Persons, please see page 1011 of this proxy statement.

Executive Sessions of Independent Directors. The board has a policy of scheduling an executive session of the independent directors as part of every regularly scheduled board meeting. These sessions are currently presided over by the lead director.

Long-Term Business Strategy. The board reviews management'smanagement’s long-term business strategy including capital allocation priorities and business development opportunities each year and approves Havertys'Havertys’ strategic plan. Updates on the key elements of the plan are reviewed by the board at each board meeting throughout the year.

Annual Evaluations. The board is committed to continuous improvement with respect to its ability to carry out is responsibilities. Each year the board and each of its independent committees, have conducted self-evaluationssupervised by the NCG Committee, conducts self-assessments related to their performance during 2017. The performance evaluationsperformance. These annual assessments are supervised byan important tool to ensure the Governance Committee and discussed by each committee and the board.board is well-positioned to provide effective oversight.

Mandatory Retirement and Resignation from Board. Our independent directors are subject to a mandatory retirement age and cannot stand for re-election in the calendar year following their 72nd birthday. On the recommendation of the GovernanceNCG Committee, the board may waive this requirement on an annual basis. A director is also required to submit his or her resignation from the board to the GovernanceNCG Committee in the event that a director retires from or otherwise leaves his or her principal occupation or employment. The GovernanceNCG Committee can choose to accept or reject the resignation.

For the 2020 Annual Meeting of Stockholders, the NCG Committee waived the mandatory retirement policy with respect to John Glover. The NCG Committee considered numerous factors including the following: Mr. Glover serves as the board’s lead director; served as audit chair for 20 years; and we valued Mr. Glover’s ability to serve as a mentor to our new directors.

Board Tenure and Refreshment. The average tenure of our non-management directors (through the end of the current board year) is 14.3 years. To anticipate future director retirements, the NCG Committee has actively been engaged in a process to affect a smooth transition of the board and fill any gaps in experience that may result.

Director Nominations.Nominations. When searching for new candidates, the GovernanceNCG Committee, whowhich has the responsibility of reviewing qualifications of candidates for board membership, considers the evolving needs of the board and searches for candidates that fill any current or anticipated future need. Nominees may be suggested by directors, members of management, stockholders, or, in some cases, by a third-party search firm. The GovernanceNCG Committee will consider recommendations for directors submitted by stockholders.

Stockholders should submit their recommendations in writing to the GovernanceNCG Committee (See, "Communications“Communications with Directors"Directors”). The proponent should submit evidence that he or she is a stockholder of Havertys, together with a statement of the proposed nominee'snominee’s qualifications to be a director. There is no difference in the manner in which the GovernanceNCG Committee evaluates proposed nominees based upon whether the proposed nominee is recommended by a stockholder.

The GovernanceNCG Committee seeks to maintain a board that is strong in its collective knowledge and has a diversity of skills and experience to oversee our business and a commitment to the goal of maximizing stockholder value. In its assessment of each potential nominee the GovernanceNCG Committee will review and consider, among other things, the nominee'snominee’s relevant career and business operations experience, judgment, industry knowledge, independence, character, gender, race, ethnicity, age, demonstrated leadership skills, financial literacy, and experience in the context of the needs of the board at the time, given the then current mix of director attributes. The GovernanceNCG Committee does not have a formal policy with respect to diversity, however, the board and the GovernanceNCG Committee believe that it is essential that the board members represent diverse viewpoints. In considering candidates for the board, the GovernanceNCG Committee considers the entirety of each candidate'scandidate’s credentials in the context of these standards. With respect to the nomination of continuing directors for re-election,re‑election, the individual'sindividual’s contributions to the board are also considered. The GovernanceNCG Committee will also take into account the ability of a nominee to devote the time and effort necessary to fulfill his or her responsibilities.

Stockholder Engagement. We value stockholder views and insights and believe management has the primary responsibility for stockholder communications and engagement. The chairman and other members of Havertys' senior management team communicate regularly with stockholders on a variety of topics throughout the year to address their questions and to seek input concerning company policies and practices. The board receives regular updates concerning stockholder feedback which cover topics including our strategy and performance, capital allocations and corporate governance matters.

Communications with Directors. The board has adopted a process to facilitate written correspondence by stockholderswelcomes questions or comments about the company and other interested parties. The board strives to provide clear, candid and timely responses to any substantive communication it receives.its operations. Interested persons wishing to write any director, committee or the board should send correspondence to the Corporate Secretary, Haverty Furniture Companies, Inc., 780 Johnson Ferry Road, Suite 800, Atlanta, Georgia 30342. Please specify to whom your correspondence should be directed. The corporate secretary has been instructed by the board to review and promptly forward all correspondence (except advertising material) to the relevant director, committee or the full board, as indicated in the correspondence.

Code These procedures may change from time to time and you are encouraged to visit our website at www.havertys.com for the most current means of Conduct. All ofcontacting our directors and employees, including our chief executive officer and executive officers, are required to complyalong with our Code to help ensure that our business is conducted in accordance withobtaining copies of the highest standards of ethical behavior.company’s governance documents.

Hedging and Pledging Policies.Policies. We prohibit our directors, officers and employees from hedging their ownership of Havertys stock, including purchasing or selling derivative securities relating to Havertys stock and from purchasing financial instruments that are designed to hedge or offset any decrease in the market value of Havertys securities. Our directors and executive officers are prohibited from pledging Havertys securities as collateral for a loan and holding any Havertys securities in margin accounts. There are no outstanding pledges or margin accounts involving Havertys securities by any of our directors or executive officers.

Havertys and the board are aware of the evolving reporting on the environmental, social, and governance (“ESG”) areas of corporate responsibility. Our corporate values inform our governance practices, the G, and it is under this umbrella that we conduct all aspects of our business. The E and S are an extension of our governance practices and we give attention to these issues. Below are how certain governance, social, and environmental practices align with our corporate values.

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

Related Party Transaction Policy.

Our board has adopted a written policy for the review, approval or ratification of certain related party transactions. The term "related“related party transaction"transaction” is defined as any transaction, arrangement or relationship or any series of similar transactions arrangements or relationships in which (1) the aggregate amount involved will exceed $120,000 in any calendar year, (2) we are a participant, and (3) any related party of Havertys (such as an executive officer, director, nominee for election as a director or greater than 5% beneficial owners of our stock, or their immediate family members) has or will have a direct or indirect interest.

The board has determined that the GovernanceNCG Committee is best suited to review and approve related party transactions. The GovernanceNCG Committee when reviewing the material facts of related party transactions must take into account whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related party'sparty’s interest in the transaction. Certain categories of transactions have standing pre-approval under the policy including: (1) certain transactions with another company in which the related party'sparty’s only relationship is as an employee (other than an executive officer), director or beneficial owner of less than 10% of that company'scompany’s stock; (2) certain transactions where the Related Person'sPerson’s interest arises solely from the ownership of our common stock and all holders of our common stock receive the same benefit on a pro rata basis (e.g. dividends, stock repurchases, rights of offerings); (3) certain banking related services in which the terms of such transactions are generally the same or similar to accounts offered to others in the ordinary course of business; and (4) transactions made on the same or similar terms available to all of our employees.

During 2017,2019, there were no related party transactions requiring approval under the policy or disclosure in this proxy statement.

Compensation Committee Interlocks and Insider Participation.

All membersThe NCG Committee consists of the Compensation Committee arefour independent directors, Mmes. Mangum and no member was an employee or former employee of Havertys. During 2017, noneDukes and Messrs. Glover and Trujillo. None of our executive officers currently serve, or in the past year have served, onas a member of the compensation committee or board of directors or compensation committee of anotherany entity whosethat has one or more executive officer servedserving on our Compensation Committeeboard or board.NCG Committee. Therefore, there is no relationship that requires disclosure as a Compensation Committee interlock.

Delinquent Section 16(a) Beneficial Ownership Reporting ComplianceReports |

Section 16(a) of the Exchange Act requires our directors, certain officers and beneficial owners of more than 10% of a registered class of our equity securities to file reports of ownership and reports of changes in ownership with the SEC. Directors, officers and beneficial owners of more than 10% of our equity securities are also required by the SEC regulations to furnish us with copies of all such reports that they file. BasedTo the company’s knowledge based solely on our review of copies of such forms and amendments provided to us, we believe that all Section 16(a) filing requirements were timely complied with during the fiscal year ended December 31, 2017.

Where to find Corporate Governance Information |

All of our corporate governance policies, including our board committee charters, Code, Governance Guidelines, Director Communication Policy and other governance documents are available on our website at havertys.com.2019.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

Ownership by our Directors and Management |

The following table sets forth the amount of Havertys'Havertys’ common stock and Class A common stock beneficially owned by each director, each named executive officer included in the Summary Compensation Table, and all current directors and executive officers as a group as of February 22, 2018.29, 2020. Unless otherwise indicated, beneficial ownership is direct, and the person shown has sole voting and investment power. An asterisk indicates less than 1% of outstanding shares of that respective class.

| | | Common Stock | | | Class A Common Stock | | | | | Shares Beneficially Owned (1) | | | Percent of Class(2) | | | Shares Beneficially Owned | | | Percent of Class(3) | | | | | | | | | | | | | | | | | Steven G. Burdette | | | 7,736 | | | | * | | | | 28,530 | | | | 1.86 | % | | J. Edward Clary | | | 71,867 | | | | * | | | | — | | | | — | | | L. Allison Dukes | | | 12,107 | | | | * | | | | — | | | | — | | | John L. Gill | | | 8,621 | | | | * | | | | 7,500 | | | | * | | | John T. Glover | | | 76,494 | | | | * | | | | — | | | | — | | | Richard B. Hare | | | 5,774 | | | | * | | | | — | | | | — | | | Rawson Haverty, Jr. | | | 10,086 | (4) | | | * | | | | 264,755 | (5)(6) | | | 17.29 | % | | G. Thomas Hough | | | 10,758 | | | | * | | | | — | | | | — | | | Mylle H. Mangum | | | 54,890 | | | | * | | | | — | | | | — | | | Vicki R. Palmer | | | 44,529 | | | | * | | | | — | | | | — | | | Clarence H. Smith | | | 74,105 | (7)(8) | | | * | | | | 717,483 | (9)(10) | | | 46.85 | % | | Al Trujillo | | | 55,190 | | | | * | | | | — | | | | — | | | Directors and Executive Officers as a group (16 persons) | | | 500,485 | | | | 2.87 | % | | | 1,018,268 | | | | 66.49 | % |

| | | Common Stock | | | Class A Common Stock | | | | | Shares Beneficially Owned (1) | | | Acquirable Within 60 Days (2) | | | Total Beneficial Ownership | | | Percent of Class(3) | | | Shares Beneficially Owned | | | Percent of Class(4) | | | | | | | | | | | | | | | | | | | | | | | Steven G. Burdette | | | 3,657 | | | | 4,583 | | | | 8,240 | | | | * | | | | 28,530 | | | | 1.61 | % | | J. Edward Clary | | | 56,091 | | | | 5,872 | | | | 61,963 | | | | * | | | | — | | | | — | | | L. Allison Dukes | | | 4,661 | | | | — | | | | 4,661 | | | | * | | | | — | | | | — | | | Richard D. Gallagher | | | 12,730 | | | | 4,459 | | | | 17,189 | | | | * | | | | 25,000 | | | | 1.41 | % | | John T. Glover | | | 68,108 | | | | — | | | | 68,108 | | | | * | | | | — | | | | — | | | Richard B. Hare | | | — | | | | — | | | | — | | | | * | | | | — | | | | — | | | Rawson Haverty, Jr. | | | 2,000 | (5) | | | 2,994 | | | | 4,994 | | | | * | | | | 614,195 | (6)(7)(8) | | | 34.75 | % | | L. Phillip Humann | | | 131,391 | | | | — | | | | 131,391 | | | | * | | | | — | | | | — | | | Mylle H. Mangum | | | 42,413 | | | | — | | | | 42,413 | | | | * | | | | — | | | | — | | | Vicki R. Palmer | | | 37,608 | | | | — | | | | 37,608 | | | | * | | | | — | | | | — | | | Clarence H. Smith | | | 75,803 | (9)(10) | | | 15,965 | | | | 91,768 | | | | * | | | | 692,483 | (11)(12) | | | 39.18 | % | | Fred L. Schuermann | | | 31,724 | | | | — | | | | 31,724 | | | | * | | | | — | | | | — | | | Al Trujillo | | | 49,307 | | | | — | | | | 49,307 | | | | * | | | | — | | | | — | | Directors and Executive Officers as a group (16 persons) | | | 589,489 | | | | 45,732 | | | | 635,221 | | | | 3.26 | % | | | 1,360,208 | | | | 76.97 | % |

| (1) | This column also includes shares of common stock beneficially owned under our directors'directors’ Deferred Plan for the following individuals: Ms. Dukes – 1,953;8,267; Mr. Glover – 11,177;12,642; Mr. HumannHough – 75,296;3,013; Ms. Mangum – 42,413;47,969; Mr. Smith – 3,962; Mr. Schuermann – 31,721;4,481; and Mr. Trujillo – 31,282.35,380. | | (2) | Represents shares of common stock that could be issued from the officers' vested SSARs with an exercise price of $18.14 and shares vesting on February 28, 2018. | (3) | Based on 19,452,14417,461,695 shares of our common stock outstanding on February 22, 2018 plus 53,557 shares that are subject to SSARs exercising or stock vesting within 60 days.29, 2020. | (4)(3) | Based on 1,767,2961,531,505 shares of our Class A common stock outstanding on February 22, 2018.29, 2020. | (5)(4) | This amount is theincludes 2,000 shares of common stock held in trust for the benefit of Mr. Haverty's minorHaverty’s children for which he is co‑trustee. | (6)(5) | Mr. Haverty has direct ownership of 82,33184,074 shares of Class A common stock. The beneficial ownership disclosed also includes 90,140 shares of Class A common stock held by a partnership for which Mr. Haverty is the general manager and 17,024 shares of Class A common stock held in trust for the benefit of Mr. Haverty'sHaverty’s minor children for which he is co-trustee. | (7) | This amount also includes shares held by H5, L.P. According to a Schedule 13D/A filed on January 3, 2018, H5, L.P. holds shared voting and dispositive power over 441,323 shares of Class A common stock. Mr. Haverty is the manager of the Partnership's general partner, Pine Hill Associates, LLC. Mr. Haverty disclaims beneficial ownership of these shares except to the extent of his partnership interest. | (8)(6) | This amount also includes 73,517 shares of Class A common stock held by the Mary E. Haverty Foundation, a charitable organization, for which Mr. Haverty has sole voting power through a revocable proxy granted to him by the Foundation. Mr. Haverty has no pecuniary interest in the shares of the Foundation and disclaims any beneficial ownership in the Foundation'sFoundation’s shares. | (9)(7) | Mr. Smith has direct ownership of 34,30217,701 shares of common stock. The beneficial ownership disclosed includes 29,689 shares of common stock held by Mr. Smith'sSmith’s wife. | (10)(8) | This amount includes 7,850 shares of common stock held by a Georgia limited partnership in which Mr. Smith is a partner. Mr. Smith disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in the partnership. | (11)(9) | Mr. Smith has direct ownership of 87,036112,036 shares of Class A common stock. The beneficial ownership disclosed includes 1,950 shares of Class A common stock held by Mr. Smith'sSmith’s wife. | (12)(10) | The amount also includes shareshares held by a partnership. According to a Schedule 13D filed on January 3, 2018, Villa Clare Partners, L.P. holds shared voting and dispositive power over 603,497 shares of Class A common stock. Mr. Smith is the manager of the Partnership'sPartnership’s general partner, West Wesley Associates, LLC. Mr. Smith disclaims beneficial ownership of these shares except to the extent of his partnership interest. |

Ownership by Our Principal Stockholders |

Set forth in the table below is information about the number of shares held by persons we know to be beneficial owners of more than 5% of the issued and outstanding of our common stock or Class A common stock. | | | Common Stock | | | Class A Common Stock | | | Name and address of Beneficial Holder | | Shares Beneficially Owned | | | Percent of Class(1) | | | Shares Beneficially Owned | | | Percent of Class(2) | | BlackRock, Inc. 55 East 52nd Street, New York, NY | | | 2,971,542 | (3) | | | 17.02 | % | | | — | | | | — | | Dimensional Fund Advisors LP 6300 Bee Cave Road, Building One, Austin, TX | | | 1,589,260 | (4) | | | 9.10 | % | | | — | | | | — | | Renaissance Technologies LLC 800 Third Avenue, New York, NY | | | 1,406,300 | (5) | | | 8.05 | % | | | — | | | | — | | The Burton Partnership, LP 614 W. Bay Street, Tampa, FL | | | 1,228,255 | (6) | | | 7.03 | % | | | — | | | | — | | The Vanguard Group 100 Vanguard Blvd., Malvern, PA | | | 1,148,164 | (7) | | | 6.58 | % | | | — | | | | — | | LSV Asset Management, 155 N. Wacker Drive, Suite 4600, Chicago, IL | | | 1,038,716 | (8) | | | 5.95 | % | | | — | | | | — | | Villa Clare Partners, L.P. 158 West Wesley Road, Atlanta, GA | | | * | | | | * | | | | 603,497 | (9) | | | 39.41 | % | Rawson Haverty, Jr. 780 Johnson Ferry Road, NE, Atlanta, GA | | | * | | | | * | | | | 264,755 | (10)(11) | | | 17.29 | % | Clarence H. Smith 780 Johnson Ferry Road, NE, Atlanta, GA | | | * | | | | * | | | | 113,986 | (12) | | | 7.44 | % |

| | | Common Stock | | | Class A Common Stock | | | Name and address of Beneficial Holder | | Shares Beneficially Owned | | Percent of Class(1) | | | Shares Beneficially Owned | | | Percent of Class(2) | | BlackRock, Inc. 55 East 52nd Street, New York, NY | | 2,811,047 | (3) | | 14.41 | % | | | — | | | | — | | Dimensional Fund Advisors LP 6300 Bee Cave Road, Austin, TX | | 1,647,551 | (4) | | 8.45 | % | | | — | | | | — | | Renaissance Technologies LLC 800 Third Avenue, New York, NY | | 1,430,200 | (5) | | 7.33 | % | | | — | | | | — | | The Burton Partnership, LP P.O. Box 4643, Jackson, WY | | 1,228,255 | (6) | | 6.30 | % | | | — | | | | — | | LSV Asset Management, 155 N. Wacker Drive, Suite 4600, Chicago, IL | | 1,053,306 | (7) | | 5.40 | % | | | — | | | | — | | The Vanguard Group 100 Vanguard Blvd., Malvern, PA | | 996,475 | (8) | | 5.11 | % | | | — | | | | — | | Royce & Associates, LLC 745 Fifth Avenue, New York, NY | | 994,300 | (9) | | 5.10 | % | | | — | | | | — | | Villa Clare Partners, L.P. 158 West Wesley Road, Atlanta, GA | | * | | | * | | | | 603,497 | (10) | | | 34.15 | % | H5, L.P. 4414 Dunmore Road, NE, Marietta, GA | | * | | | * | | | | 441,323 | (11) | | | 24.97 | % | Rawson Haverty, Jr. 780 Johnson Ferry Road, NE, Atlanta, GA | | * | | | * | | | | 155,848 | (12)(13) | | | 8.82 | % | Clarence H. Smith 780 Johnson Ferry Road, NE, Atlanta, GA | | * | | | * | | | | 88,986 | (14) | | | 5.04 | % |

| (1) | Based on 19,452,14417,461,695 shares of our common stock outstanding on December 31, 2017 plus 53,557 shares that are subject to SSARs exercising or stock vesting within 60 days.February 29, 2020. | | (2) | Based on 1,767,2961,531,505 shares of our Class A common stock outstanding on December 31, 2017.February 29, 2020. | | (3) | According to a Schedule 13G filed on January 19, 2018,February 4, 2020, BlackRock, Inc. holds sole voting power over 2,753,4822,918,213 shares and sole dispositive power over 2,811,0472,971,542 shares of common stock. | | (4) | According to a Schedule 13G filed on February 9, 2018,12, 2020, Dimensional Fund Advisors LP ("Dimensional"(“Dimensional”) holds sole voting power over 1,591,0041,540,277 shares and sole dispositive power over 1,647,5511,589,260 shares of common stock. Dimensional is an investment advisor registered under Section 203 of the Investment Advisors Act of 1940 and furnishes investment advice to four investment companies registered under the Investment Company Act of 1940 and serves as investment manager or sub-advisor to certain other commingled funds, group trusts and separate accounts (the "Funds"“Funds”). The shares reported above are owned by the Funds. Dimensional possesses investment and/or voting power over the shares held by the Funds. The shares are owned by the Funds and Dimensional disclaims beneficial ownership of these securities. | | (5) | According to a ScheduledSchedule 13G filed on February 14, 2018,13, 2020, Renaissance Technologies LLC (“RTC”) holds sole voting power over 1,394,100 shares of common stock, and sole dispositive power over 1,430,0001,399,597 shares and shared dispositive power over 6,703 shares of common stock. | | (6) | According to a Schedule 13G filed on June 1, 2016, The Burton Partnership, LP, The Burton Partnership (QP), LP and Donald W. Burton, General Partner holdshold sole voting and dispositive power over 1,228,255 shares of common stock. | | (7) | According to a Schedule 13G filed on February 13, 2018, LSV Asset Management12, 2020, The Vanguard Group holds sole voting power over 517,35019,392 shares and shared voting power over 2,000 shares and sole dispositive power over 1,053,3061,131,071 shares and shared dispositive power over 17,093 shares of common stock. | | (8) | According to a Schedule 13G filed on February 8, 2018, The Vanguard Group11, 2020, LSV Asset Management holds sole voting power over 20, 433582,600 shares and sole dispositive power over 974,9421,038,716 shares of common stock. | | (9) | According to a Schedule 13G filed on January 22, 2018, Royce & Associates, LP holds sole voting and dispositive power over 994,300 shares of common stock. | (10) | According to a Schedule 13D/A filed on January 1,3, 2018, Villa Clare Partners, L.P. holds shared voting and dispositive power over 603,497 shares of Class A common stock. Clarence H. Smith is the manager of the Partnership'sPartnership’s general partner, West Wesley Associates, LLC. Mr. Smith disclaims beneficial ownership of these shares except to the extent of his partnership interest. | (11) | According to a Schedule 13D/A filed on January 3, 2018, H5, L.P. holds shared voting and dispositive power over 441,323 shares of Class A common stock. Rawson Haverty, Jr. is the manager of the Partnership's general partner, Pine Hill Associates, LLC. Mr. Haverty disclaims beneficial ownership of these shares except to the extent of his partnership interest. | (12)(10) | Mr. Haverty has direct ownership of 82,33184,074 shares of Class A common stock. The beneficial ownership disclosed also includes 90,140 shares of Class A common stock held by a partnership for which Mr. Haverty is the general manager and 17,024 shares of Class A common stock held in trust for the benefit of Mr. Haverty's minorHaverty’s children for which he is co-trustee. | (13)(11) | This amount also includes 73,517 shares of Class A common stock held by the Mary E. Haverty Foundation, a charitable organization, for which Mr. Haverty has sole voting power through a revocable proxy granted to him by the Foundation. Mr. Haverty has no pecuniary interest in the shares of the Foundation and disclaims any beneficial ownership in the Foundation'sFoundation’s shares. | (14)(12) | Mr. Smith has direct ownership of 87,036112,036 shares of Class A common stock. The beneficial ownership disclosed includes 1,950 shares of Class A common stock held by Mr. Smith'sSmith’s wife. |

COMPENSATION DISCUSSION AND ANALYSIS |

| WHERE TO FIND IT: | | | Role of the NCG Committee | 14 | | Recap of 2019 NEO Compensation Program | 15 | | Executive Compensation Framework | 16 | | Executive Compensation Components | 17 | | How We Make Compensation Decisions | 20 |

The purpose of this Compensation Discussion and Analysis ("(“CD&A"&A”) is to provide stockholders with a description of our executive compensation philosophy, the material elements of the program and the policies and objectives which support the program. This CD&A provides information on the program for all Havertys'Havertys’ executive officers but focuses on the compensation of our named executive officers for 2017.2019. The individuals who were subject to the SEC Section 16 reporting requirements during 20172019 are referred to as the "executive“executive officers."” Our named executive officers (NEOs) for 20172019 includes our CEO, two individuals that served as our CFO, during 2017, and our next three most highly-compensation executive officers.

WHERE TO FIND IT: | | Role of the CompensationNCG Committee | 13 | Executive Compensation Framework | 14 | How We Make Compensation Decisions | 15 | Executive Compensation Components | 18 | Recap of 2017 NEO Compensation Program | 20 |

Role of the Compensation Committee |

The CompensationNCG Committee is composed of independent directors and is responsible for the approval and oversight of compensation programs for executive officers, equity plan awards and benefit programs for all of our employees.

The CompensationNCG Committee took the following steps to ensure that it effectively carried out its responsibilities:

✓✔ | Conducted an annual review of our compensation philosophy to ensure that it remains appropriate given strategic objectives; | ✓✔ | Reviewed results from an annual review of compensation data related to our peers; | ✓✔ | Reviewed and approved all compensation components for our chief executive officer, chief financial officer, and other NEOs; | ✓✔ | Performed an annual evaluation of the execution of our pay-for-performance philosophy, to ensure that the actual award decisions resulted in alignment of relative pay and relative performance compared to the compensation peer group; | ✓✔ | Scheduled an executive session, without members of management, for the purpose of discussing decisions related to the chief executive officer'sofficer’s performance, goal-setting, compensation level and other items deemed important by the CompensationNCG Committee; and | ✓✔ | Reviewed succession planning with the CEO and in executive session of the board. |

| COMPENSATION DISCUSSION AND ANALYSIS |

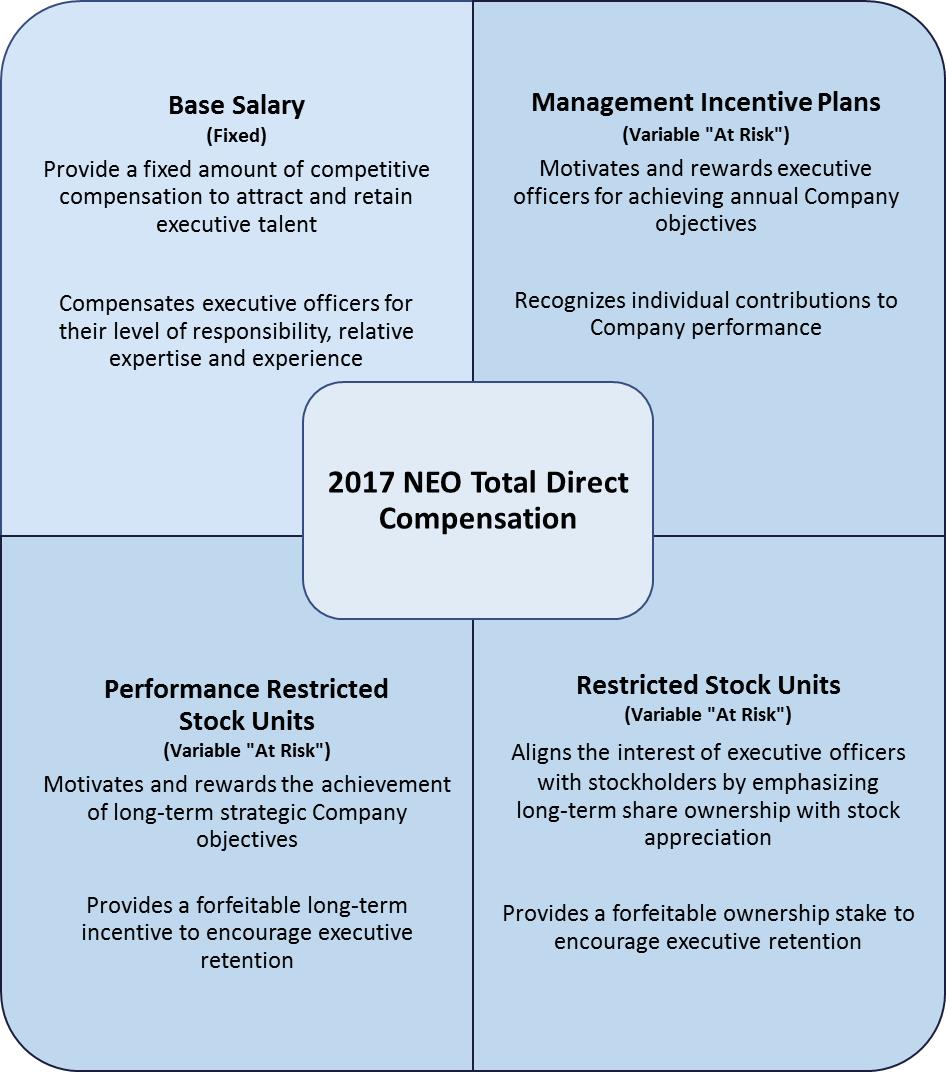

RECAP OF 2019 NEO COMPENSATION PROGRAM | Base Salary (Fixed Pay) | | Key Features | • Fixed annual cash amount. • Base pay increases considered on a calendar year basis or at time of promotion to align with the median range of our peer group (as described on page 17 of this CD&A&A). Actual positioning varies to reflect each executive’s skills, experience and contribution to our success. | | Purpose | • Provide a fixed amount of cash compensation to attract and retain talented executives. • Differentiate scope and complexity of executives’ positions as well as individual performance over time. | | 2019 Actions | • Base salaries remained the same in 2019, except for Mr. Gill due to his promotion. • Salaries for the NEOs were last increased in 2018 and in 2014 for the then NEOs. | Cash Awards Under Management Incentive Plans (Variable “At Risk” Compensation) | Key Features | • Individual MIP opportunities are expressed as a percent of base salary and can vary for executives based on their positions. Target MIP award opportunities are generally established so that total annual cash compensation (base salary plus target MIPs) approximates the median of our peer group. • Performance-based cash incentive pay is comprised of two plans: MIP-I is tied to the company achieving certain pre-tax earnings levels during the year (80% of total target cash incentive pay) and MIP-II is based on successfully meeting individual goals (20% of total target cash incentive pay). • The range of potential payout for actual results relative to these goals is zero to 175 percent of target. • MIP amounts are earned based on the results achieved as determined by the Committee after evaluating company and individual performance against pre-established goals. | | Purpose | • Motivate and reward achieving or exceeding company and individual performance objectives, reinforcing pay-for-performance. • Align performance measures for NEOs on key business objectives to lead the organization to achieve short-term financial and operational goals. • Ensure alignment of short-term and long-term strategies of the company. |

2019 Actions |

• Actual performance in 2019 resulted in total MIP-I earned at 44.5% of its target and MIP-II earned at 58.2% to 100.0% of its target for the NEOs.

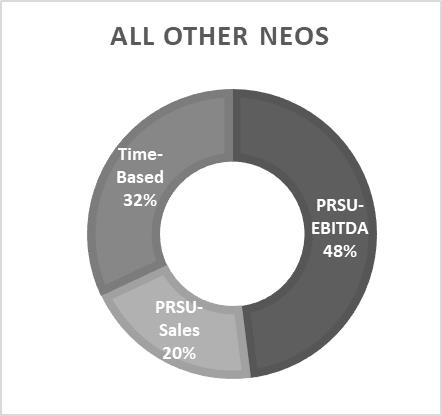

| Long-Term Equity Incentive Compensation (Variable “At Risk” Compensation) | | Key Features | • Awards granted annually based on competitive market grant levels. • Awards to NEOs are in the form of performance restricted stock units (PRSU) based on EBITDA or Sales and in the form of time-based restricted stock units. • Vesting: The PRSUs granted in 2019 that are earned will cliff vest in February 2022 and are forfeitable upon termination of employment, except in the cases of death, disability or normal retirement. The restricted stock units vest in equal increments over a four-year period. These grants are forfeitable upon termination of employment, except in the cases of death or disability. | | Purpose | • Stock-based compensation links executive compensation directly to stockholder interests. • PRSUs provide a direct connection to company performance and executives’ goals. • Multi-year vesting creates a retention mechanism and provides incentives for long-term creation of stockholder value. | | 2019 Actions | • 2019 awards to NEOs as a percentage of total target compensation were granted at the same levels as in 2018 and with the same mix of time-based restricted stock units and performance-based awards tied to EBITDA and Sales. • 2019 performance-based awards tied to EBITDA were earned at 46.4% of target and no shares were earned for awards tied to Sales. |

| COMPENSATION DISCUSSION AND ANALYSIS |

Executive Compensation Framework |

The Company'scompany’s executive compensation framework includes the following, each of which the CompensationNCG Committee believes reinforces its philosophy and objectives.

What We Do: | ✔ | What We Do:

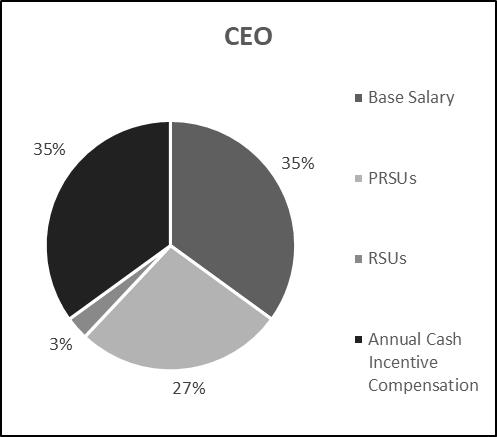

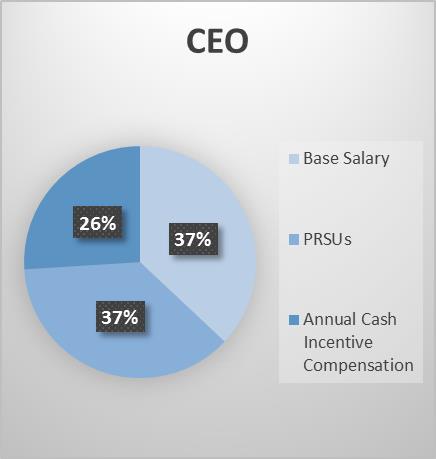

| | ✓Pay-for-performance. A significant percentage of targeted annual compensation is delivered in the form of variable compensation that is connected to actual performance. For 2017,2019, variable compensation comprised approximately 63%65% of the targeted annual compensation for the chief executive officer and, on average, 55% of the targeted annual compensation for the other named executive officers.

|

| ✔ | ✓Provide competitive target pay opportunities. We annually benchmarkevaluate our target and actual compensation levels and relative proportions of the types of compensation against our peer group. We use informed judgment in special cases in order to offer the compensation appropriate to motivate and attract highly talented individuals to enable our long-term growth.

|

| ✔ | ✓Linkage betweenAlign performance measures to a mix of key strategic and strategicoperating objectives. Performance measures for incentive compensation are linked to both strategic and operating objectives designed to create long-term stockholder value and to hold executives accountable for their individual performance and the performance of the Company.company.

|

| ✔ | ✓Future pay opportunity important componentLink compensation to future stock performance. In 2017,2019, all of the long-term incentive awards delivered to our named executive officers were in the form of equity-based compensation. For 2017,2019, long-term equity compensation comprised approximately 26%31% of the targeted annual compensation for the chief executive officer and 28%29% of the targeted annual compensation for the other named executive officers.

|

| ✔ | ✓Mix of performance metrics. The Company utilizes a mix of performance metrics that emphasize links between incentive compensation and the Company's strategic operating plan and financial results.

| | ✓OutsideRetain an outside compensation consultant. The CompensationNCG Committee retains an independent compensation consultant to review the Company'scompany’s executive compensation program and practices.

|

| ✔ | ✓MaximumEstablish maximum payout caps for annual cash incentive compensation and PSUs.

Performance Restricted Stock Units (PRSUs). |

| ✔ | ✓"Clawback"Maintain a “Clawback” Policy. The Companycompany may recover incentive compensation paid to an executive officer that was calculated based upon any financial result or performance metric impacted by fraud or misconduct of the executive officer.

|

| ✔ | ✓Require meaningful stock ownership.Stock Per our stock ownership guidelines. Ourguidelines, our chief executive officer is required to have qualified holdings equal to the lesser of a multiple of three times his base salary or 85,000 shares. Our CEO'sCEO’s qualified holdings were 187,784156,711 shares at December 31, 2017.2019. The other named executive officers are requiredalso subject to have qualified holdings equal to the lesser of a multiple of two times their base salary or 40,000 shares. Our other named executive officers', excluding Mr. Hare,ownership guidelines. Their qualified holdings ranged from 50,651 shares13,544 to 73,65879,661 shares at December 31, 2017.2019. New officers have three years to meet required ownership guidelines.

|

| ✔ | ✓Mitigate undue risk-taking in compensation programs. Our compensation programs for our executive officers contain features that are designed to mitigate undue risk-taking by our executives.

| | ✓"Double trigger" in the event of a change-in-control. In the event of a change-in-control, severance benefits are payable only upon a "double trigger."

| | |

| ✔ | Require a “double trigger” for change-in-control severance benefits to be payable. |

| What We Don't Do:

| | X | ûNo repricing or buyout of underwater stock options. Our equity plan does not permit the repricing or buyout of underwater stock options or stock appreciation rights without stockholder approval, except in connection with certain corporate transactions involving the Company.company

|

| X | ûProhibition against margins,margin loans, pledging, and hedging or similar transactions of Companycompany securities by senior executives and directors.

|

| X | ûNo dividends or dividend equivalents are accrued or paid on unvested and/or unexercised awards.

|

| X | ûNo change-in-control tax gross ups. We do not provide change-in-control tax gross ups.

|

| X | ûNo significant perquisites. We do not provide our employees, including our NEOs, with significant perquisites.

| | |

CD&ACOMPENSATION DISCUSSION AND ANALYSIS |

Executive Compensation Components |

Although there is no pre-established policy or target for the allocation between specific compensation components, a significant portion of an executive officer’s annual total target compensation is determined by company performance as compared to goals established for our annual cash incentive plan and the ultimate value of long-term incentive plans. We believe this approach reflects our executive compensation philosophy and objectives.

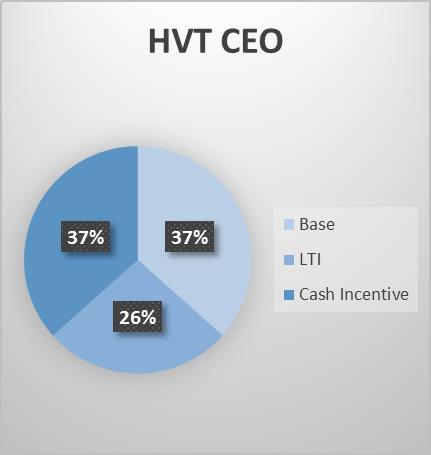

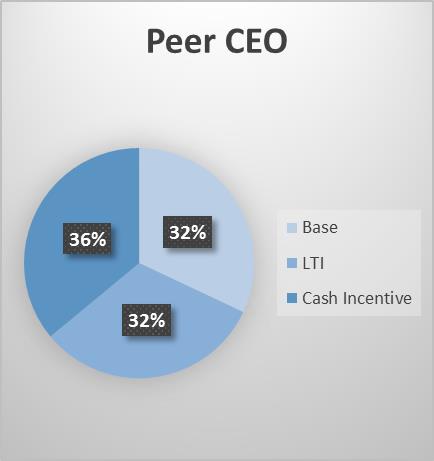

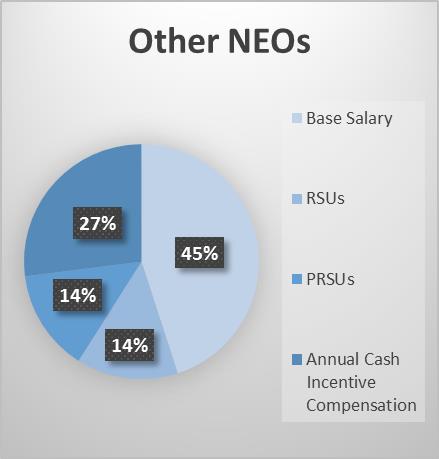

The graphs below illustrate how total compensation for our named executive officers at January 2019 was allocated between performance-based and fixed components, how performance-based compensation is allocated between annual and long-term incentive components and how total compensation is allocated between cash and equity components. The company strives to structure various elements of these program components so that a large portion of executive compensation is directly linked to advancing the company’s financial performance and the interest of shareholders. These percentages are based on annualized total target compensation values and do not necessarily correspond to, and are not a substitute for, the values disclosed in the “Summary Compensation Table” and supplemental tables provided later in this Proxy Statement. Base Salary. The base salary provides a fixed amount of competitive compensation to attract and retain executive talent by compensating executive officers for their level of responsibly, relative expertise and experience. The Committee reviews the information regarding executives’ base salary levels compared to the base salaries of executives of companies in our peer group. The Committee also considers the chief executive officer’s assessment of each executive’s individual performance and responsibilities to determine appropriate compensation for each executive. The Committee has determined that, in order to enable the company to attract and retain the executive talent important to our long-term growth, the compensation strategy should generally aim to position base salaries within +/-10% of the median of the peer group data.

In determining base salaries for executives, as well as in determining incentive compensation opportunities, the Committee evaluates each executive’s individual performance on both an objective and subjective basis. The Committee considers the chief executive officer’s evaluation of an executive’s performance along with the scope of responsibilities and individual seasonings and experience. Further, the Committee reviews the competitive compensation data and exercises its judgment regarding base salary decisions for each executive.

| COMPENSATION DISCUSSION AND ANALYSIS |

Management Incentive Plans Cash Award. Our compensation philosophy connects our executives’ potential annual cash earnings to performance. Our 2019 Long-Term Incentive Plan (the “2019 LTIP”) provides for the payment of cash under two plans (the “MIPs”). The Committee approved the MIP designs and targets in January 2019 as part of the annual compensation setting process. The target cash incentive amount for the combined MIPs as a percent of base salary was 60% for our named executive officers, except for Mr. Smith for whom it was 100% and Mr. Gill for whom it was 50%. As in prior years, MIP-I is based upon pre-tax earnings goals and is 80% of the total cash incentive target and MIP-II is based on individual goals and represents 20% of the total cash incentive target.

The earnings-based MIP-I structure was designed so executives could earn above-target payouts when performance significantly exceeded financial goals and below target payouts when goals are not achieved. The MIP-I provided for a 3% change in the incentive earned of the target for every 1% increase or decrease in pre-tax earnings versus the goal starting at a 40% payment of the target when pre‑tax earnings is 80% of the goal, with a maximum of 175% payment of the target when pre-tax earnings is 125% of the goal. The MIP-II design supports individual goals with payout ranging from 0% to 100% of target. See page 25 which details the estimated possible payouts under this non-equity incentive plan award.

The company’s pre-tax earnings quarterly and annual targets for 2019 were:

| | Q-1 | | | | Q-2 | | | | Q-3 | | | | Q-4 | | | Annual | | | $ | 7,700,000 | | | $ | 8,600,000 | | | $ | 12,300,000 | | | $ | 12,400,000 | | | $ | 41,000,000 | |

Consistent with our historical approach, MIP-I includes quarterly targets to reflect the pace of our business as well as an annual objective, which is more heavily weighted (at 60% of the plan) than the individual quarters. The MIP-I targets were set in January 2019 and the estimated impact of the 10% tariffs placed on goods imported from China that begun in September 2018 was factored into the targets. The plan structure provides for adjustments to targets to eliminate the effects of accounting changes and the impact of unusual or non-recurring items. The adjustments for 2019 were generated by the following: adoption of new lease accounting standards, an impairment charge for a retail store, and the increase in tariffs to 25% on March 4, 2019. The Committee reviewed the adjustments and their impact on the financial targets. The adjustments, in their totality, resulted in a MIP‑I payout of approximately 81% of target. The company’s management noted that a payout at this level would have a detrimental effect on earnings already negatively impacted by the impairment charge and the increased tariffs and recommended that the Committee reduce payouts from the formulaic results.

The Committee considered the consequences of the MIP-I payout at 80.7% of target on the company’s earnings and shareholder value and used its negative discretion to reduce the MIP-I payout percentage to 44.5% of target.*

The Committee also reviewed the payout results from the MIP-II. The individual goal payouts under the MIP-II for the NEOs ranged from 58.2% to 100.0%.

The combination of the approved MIP-I and MIP-II payouts resulted in a total MIP payout of 47.2% of target for Mr. Smith and between 51.7% and 55.6% of target for the other NEOs.

See the “Summary Compensation Table,” which shows the actual non-equity incentive plan compensation paid to our named executive officers for our 2019 performance. *Adjusted Pre-Tax Earnings is a non-GAAP financial measure. A reconciliation of the 2019 Adjusted Pre-Tax Earnings approved by the Committee for determining the MIP-I payout to the most directly comparable GAAP financial measure is provided in the Appendix. | COMPENSATION DISCUSSION AND ANALYSIS |

Long-Term Equity Incentive Compensation. Our executives receive long-term equity incentive compensation intended to link their compensation to the company’s long-term financial success. All equity awards for our executives are approved by the Committee and the 2019 annual equity award grants were set at its meeting in January 2019. The 2019 grants were comprised of a mix of PRSUs based on EBITDA, PRSUs based on sales, and time-based restricted stock units. For the NEOs at January 2019 the target equity compensation was approximately 30% of total target compensation.

The chart below highlights the mix of the types of equity awards granted in 2019.

The EBITDA-based PRSU grants use adjusted EBITDA as the performance measure to determine the number of shares that will vest. The 2019 EBITDA target was $71.5 million, exclusive of adjustments to eliminate the effects of changes in accounting and unusual or non-recurring items, with a range from a threshold of $57.2 million that would earn 40% of the target shares to a maximum of $89.4 million that would earn 175% of the target shares.

Adjusted EBITDA for 2019 was calculated at $58.7 million, resulting in 46.4% of the target number of shares being earned.* The shares will cliff vest in February 2022.

The Sales-based PRSU grants use comparable store sales to determine the number of shares that will vest. The sales target for 2019 was a 1.5% increase in comparable store sales, with a range from a threshold of an increase of 0.5% that would earn 40% of the target shares to a maximum of a 3.5% increase that would earn 120% of the target shares. Comparable store sales decreased 1.4% in 2019, as a result, all of the Sales-based PRSUs granted in 2019 were forfeited.

Prior to 2018, Mr. Smith received PRSUs based on exceeding sales targets in the grant year as well as increasing sales amounts in each of the three succeeding years. The number of shares achieved is solely dependent on each individual year and earned shares cliff vest in May following the measurement year. The sales target for 2019 for the grants made in 2016 and in 2017 were $871.2 million and $871.9 million, respectively, and no shares were earned for these awards.

The time-based restricted stock units vest in four equal annual installments beginning in May 2020.

Dividend and voting rights are not applicable to stock awards until vested and/or exercised. Additional details regarding grants are provided in the “Grants of Plan Based Awards Table” and “Outstanding Equity Awards Value at Year-End Table.”

*Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of the 2019 Adjusted EBITDA approved by the Committee for determining the EBITDA-based PRSU payout to the most directly comparable GAAP financial measure is provided in the Appendix.

| COMPENSATION DISCUSSION AND ANALYSIS |

How We Make Compensation Decisions |

The Committee has overall responsibility for approving and evaluating the Company'scompany’s executive officersofficer’s compensation plans, policies and programs. The Committee is also responsible for providing a CompensationNCG Committee report reviewing the Company'scompany’s CD&A. The Committee uses several different tools and resources in reviewing elements of executive compensation and making compensation decisions. These decisions, however, are not purely formulaic and the Committee exercises judgment and discretion in making them.

Compensation Consultants. The Committee retained Meridian Compensation Partners, LLC ("Meridian"(“Meridian”) as an independent consultant to provide advice on executive compensation matters. Meridian serves as a resource for market data on pay practices and trends and provides independent advice to the Committee for setting executive compensation. Meridian reports directly and exclusively to the Committee Chair. However, at the Committee'sCommittee’s direction, Meridian works with management to review or prepare materials for the Committee'sCommittee’s consideration. Meridian provided no additional services to Havertys outside of the scope of the agreement with the Committee.

During 2017,2019, the Committee reviewed Meridian'sMeridian’s independence and determined that there were no conflicts of interest as a result of the Committee'sCommittee’s engagement of Meridian. The Committee did not engage any consultant other than Meridian during 20172019 to provide compensation consulting services.

Compensation Analysis. In determining appropriate compensation opportunities for our named executive officers, the Committee received input from Meridian. WeThe Committee reviewed and analyzed competitive market data to be used as background for 20172019 pay decisions and to obtain a general understanding of current compensation practices. This data was referenced when targeting the positioning for compensation discussed below. Data sources included public company proxy statements, broad-based published compensation surveys and other sources. WeThe Committee compared compensation opportunities for our named executive officers with pay opportunities available to executive officers in comparable positions at similar companies (our "peer group"“peer group”). The peer group included companies from the retail furniture industry, retailers of big ticket postponable items, and specialty retailers. The peer group is re-evaluated annually to take into account changes in their operations and our own. Changes were made to the prior year peer group to more closely align it with Havertys’ business. Kimball International, Inc. and Vera Bradley, Inc. were added to the peer group. West Marine, Inc. was acquired and removed from the peer group. The peer group companies used in setting 20172019 compensation are shown below. | PEER GROUP | | American Woodmark Corporation | | Ethan Allen Interiors Inc. | | OxfordKnoll, Inc. | | | At Home Group Inc. | | Flexsteel Industries, Inc. | | La-Z-Boy Incorporated | | | Bassett Furniture Industries Inc. | | Flexsteel Industries,Hibbett Sports, Inc. | | Select Comfort CorporationOxford Industries, Inc. | | | Big 5 Sporting Goods Corporation | | Hibbett Sports, Inc.Hooker Furniture | | Shoe Carnival,Pier 1 Imports, Inc. | | Conn'sConn’s, Inc. | | Kirkland'sKimball International, Inc. | | West Marine, Inc.Sleep Number Corporation | | | Culp, Inc. | | Knoll,Kirkland’s Inc. | | Zumiez,Vera Bradley, Inc. | | Dixie Group, Inc. | | La-Z-Boy Incorporated | | | |

Role of CEO. The compensation of every Havertys employee, including each named executive officer, is influenced in large part by the responsibilities of the position and the need to ensure that employees having similar job responsibilities are paid equitably, with consideration for individual performance. During early 2017,2019, Mr. Smith provided recommendations to the CompensationNCG Committee with respect to the base salary amounts, performance targets for the annual and long-term incentive programs, and any equity awards for each executive officer.officer (other than himself). These recommendations were based on the data reviewed by the Committee and Mr. Smith'sSmith’s assessment of the executive'sexecutive’s relative experience, overall performance, and impact on the accomplishment of Havertys' financial goals and strategic objectives during the prior year. While the CompensationNCG Committee took Mr. Smith'sSmith’s recommendations under advisement, it independently evaluated the pay recommendations for each executive and made all final compensation decisions in accordance with its formal responsibilities as defined in its Charter.